July 2021 NEW Stamp Duty Changes

Posted on 23rd July 2021

Our leading team of property solicitors discuss the new stamp duty changes from July 2021, and advise how best to go about your property purchase.

If you have had any interest in the last year about buying, or indeed selling, a property, you will no doubt be all too aware of the stamp duty holiday introduced by the government to try and keep the property market afloat.

These changes meant that the tax-free threshold on a property being purchased was bumped up to £500,000 from the previous £125,000 that it was previously at for existing homeowners, and the £300,000 that it was at for first time buyers.

The stamp duty holiday has been a hot topic in the property and conveyancing world, and for good reason. It essentially allowed people to make savings of up to £15,000 when purchasing their property. Well-known property site, Rightmove, has gone as far as to suggest that the scheme has been used by over 1.3 million people so far.

Here at MG Legal, our leading conveyancing solicitors have assisted hundreds of property buyers with purchases benefitting from the stamp duty holiday, and continue to this day. We are regularly inundated with questions about the scheme, such as ‘what are the stamp duty holiday rules?’, ‘How does the stamp duty holiday work?’, and more recently, ‘what date does the stamp duty holiday end?’. Our helpful team answer all of these questions below.

How does the stamp duty holiday work?

Essentially, the stamp duty holiday is a form of tax holiday, which stated that those buying property in England and Northern Ireland did not have to pay tax on properties up to £500,000 in value. It was introduced by the Chancellor on 8th July 2020, and was fully in place until 30th June 2021.

From July 2021 onwards, the stamp duty holiday had been reduced, and so have the savings that can be made using it.

What are the new changes to stamp duty in July 2021?

From 1 July onwards, the stamp duty holiday changed. Now, the 0% band for stamp duty in England, or properties for which buyers will pay no stamp duty, has been reduced to £250,000, from the previous £500,000. In Wales, the stamp duty holidays have come to a complete close and have now returned back to their original values.

It is, therefore, unfortunately too late for property buyers to make full use of the scheme and make savings of £15,000, but our leading property and conveyancing solicitors would still recommend people in England who are looking to buy property to do so as soon as possible, as there are still significant financial savings to be made.

Under the current regulations, people purchasing property in England are able to make savings of up to £2,500 when buying property valued at £250,00 and under.

Has the stamp duty holiday been extended again?

The stamps duty holiday was officially set to end on March 31 2021 when it was originally introduced in July of 2020. However, due to the success of the scheme in keeping the property market going, and the continued financial impact of the covid-19 pandemic, the scheme was extended in full until June 30th 2021.

The partially reduced stamp duty regulations, as they stand now in July 2021, will be in place in England until 30th September 2021, meaning that savings can still be made on eligible property purchases until this date.

From this point onwards, according to government announcements, the stamp duty holiday will come to a complete end, and the stamp duty will return to the original rates, and standard tax rates and charges will be once again in place for all property purchases valued at £125,000 and over.

Will house prices go down after the stamp duty holiday?

With news that the stamp duty holiday will be coming to a complete end in upcoming months, many people wanting to purchase property may be thinking, ‘is it worth the rush to meet the stamp duty holiday deadline?’. Our specialist team of property and convening solicitors would advise you that in order to answer this question, you must assess your own situation.

If you are in a position where you have established the key aspects of the property that you wish to buy, such as the location and size, and either have a mortgage approval or are in the finical position to have one safely approved, then it could be worth going ahead with your purchase sooner rather than later if it means making savings of £2,500. If you find yourself in this position, get in touch with our team of property and conveyancing solicitors today to get your property purchase underway as soon as possible.

Still, our leading property experts would always advise you not to simply rush into buying a property, when you are not ready to do so, simply to meet the final stamp duty holiday deadline. This is a risky way to go about buying your dream home, and making a decision that will affect your life for the foreseeable future. If you are relying on the tax holiday in order to have sufficient funds to make your purchase, you always run the risk of coming into unforeseeable delays, and having to pull out of the property chain due to insufficient funds if you miss the deadline.

There is some talk among property experts, that our property solicitors team is keeping close track of, that house prices could fall in upcoming months, and into 2022, as the stamp duty holiday comes to an end. If this is the case, many property buyers could in fact benefit from waiting a few months until they decide to purchase their property.

Can I still save under the new stamp duty holiday?

As previously mentioned, the 0% band for stamp duty taxes in England is now at £250,000, down from £500,000.

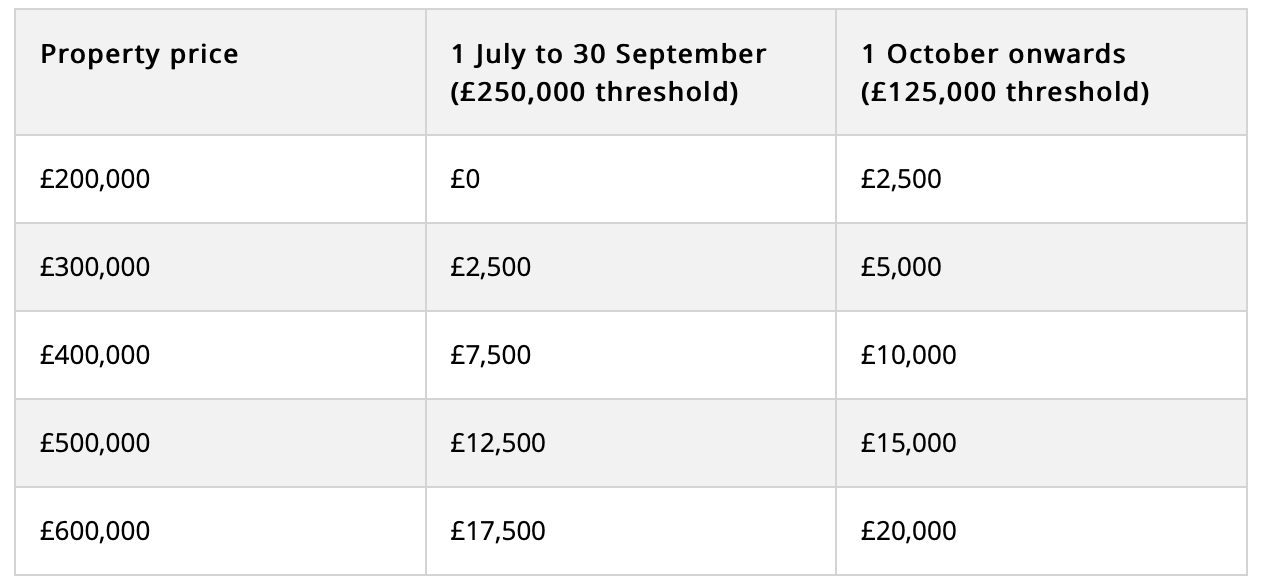

Below, a helpful table provided by Which, shows the potentials savings that buyers could still make under these new regulations and changes:

Speak to a specialist property solicitor today:

If you are looking for more information on your options under the new stamp duty holiday regulations, or simply want to speak to an expert about buying or selling a property in the upcoming months, then contact our team of leading conveyancing solicitors today for a no-obligation discussion. We can advise you as to the best options going forward, and how our reliable services can help you.

Our team are experts in all aspects of property conveyancing, from house purchases and property sales, to re-mortgaging and property leases, and offer all of our services at clear, fixed-fee prices. See a collection of our fees, here.

Simply get in touch online today, here, and hear back from a friendly member of our team within one working hour. Otherwise, send us an email today at enquiries@mglegal.co.uk , or give us a call on 01995 602 129 .

If you live in the local area, and would rather speak to one of our friendly property solicitors in person, then come and see us at one of our office locations in Garstang, Lancaster, or Longridge.

Share this post: